This is a summary excerpt of my guest lecture at 靜宜大學 on October 4th, 2023. For further information about this lecture, please contact me directly.

Classification of Banking

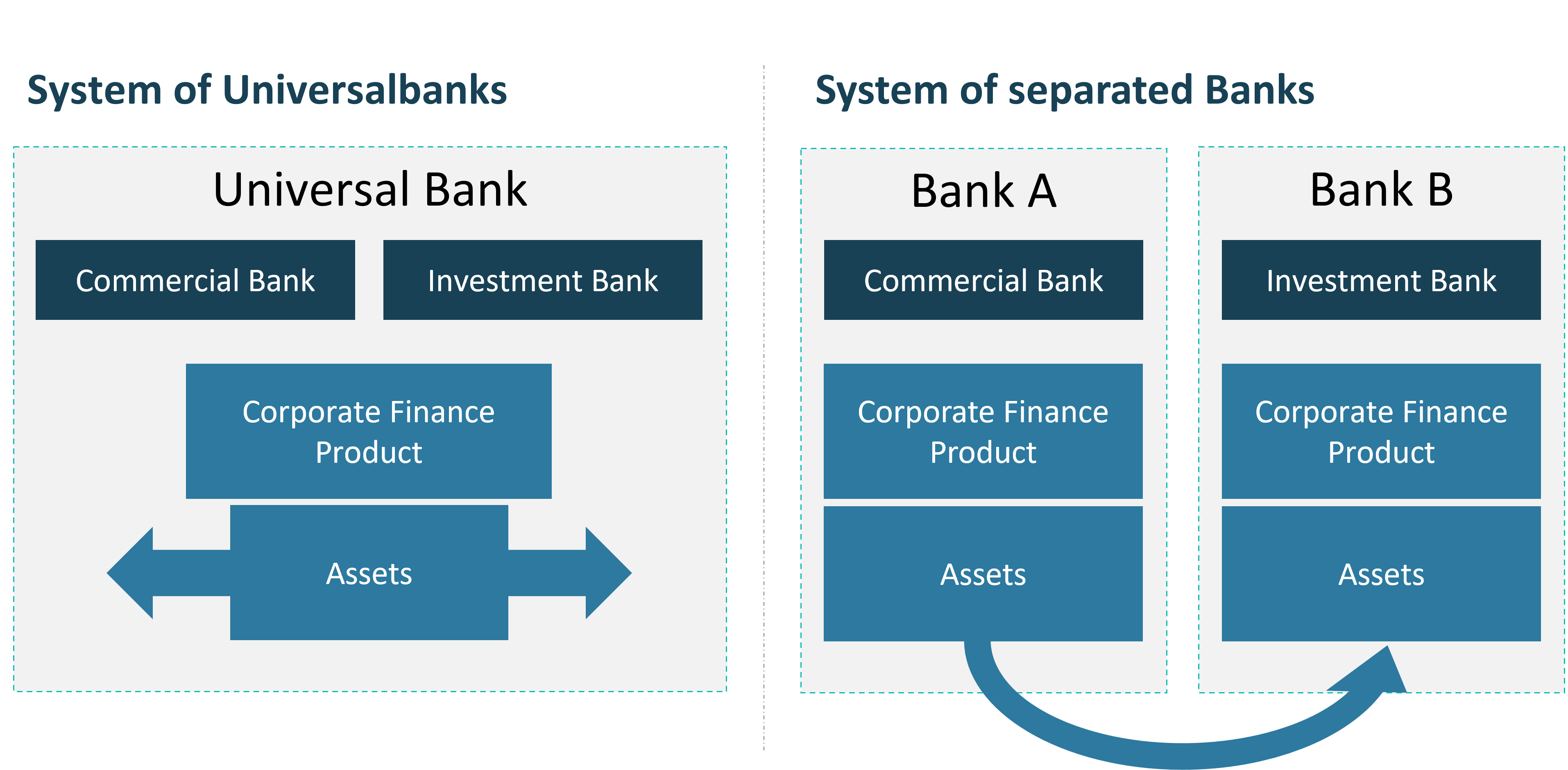

In general Banking systems can exist in two different forms:

- System of universal banks

- System of separated banks

Comparison of banking systems

Universalbanks unify Commercial Bank Services together with Investment Bank services. Therefore these kinds of banks can offer a complete portfolio of service out of one hand and share assets between different services. For example a corporate client can keep different foreign exchange accounts at a bank and ask to use the bank to also care about the risk management of these foreign currencies to balance out market movements. Therefore the business can be much more efficient. Usually these banks are found in the European market.

The system of seperated banks has its origin in the anglo-american market and devides Commercial Banking services from Investment Bank services by seperating them into different entities. Therefore a mix of assets is not possible anymore and clients need to keep relations with multiple company entities. The advantage of this concept is a highly specialized banks and therefore less risk exposure.

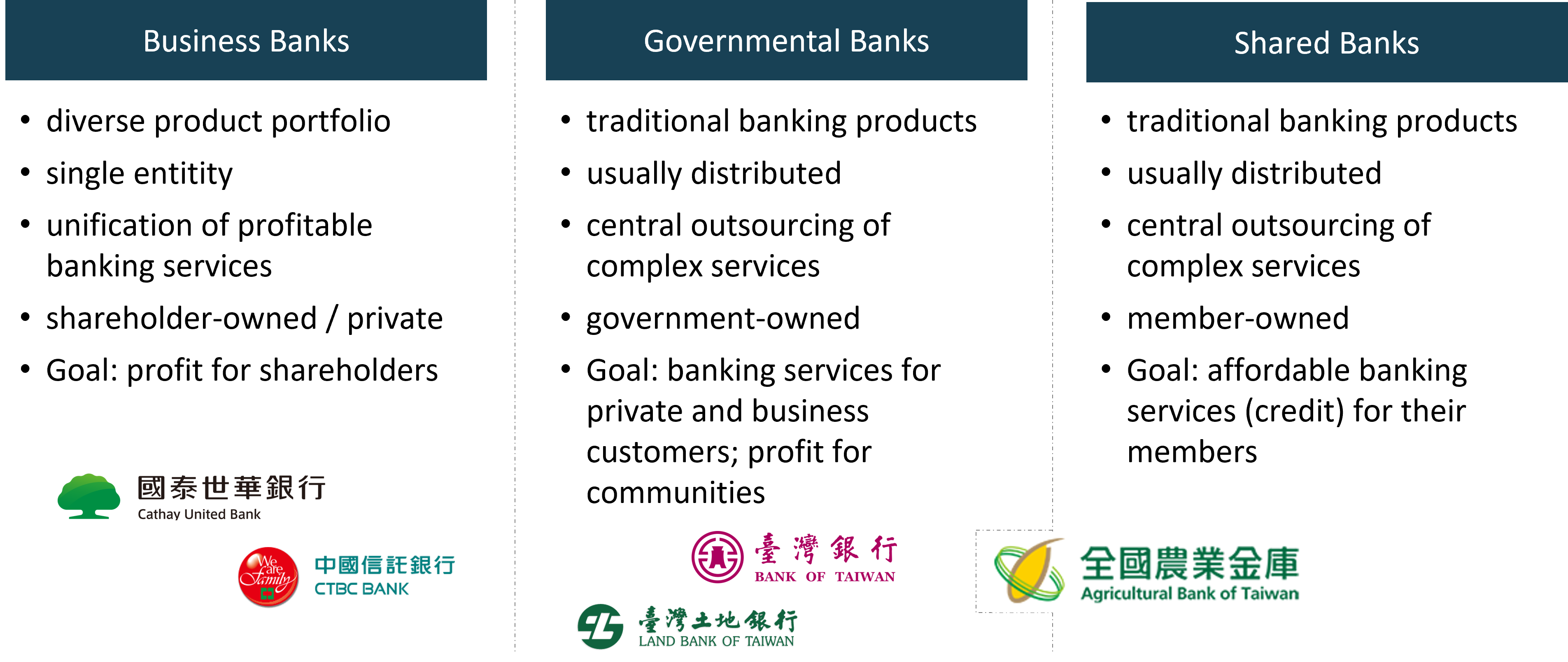

Furthermore Banks can be broadly classified into three categories: Business Banks, Governmental Banks, and Shared Banks.

Comparison of bank types

- Business Banks are single entities that offer a diverse product portfolio. They aim to unify profitable banking services and are usually shareholder-owned or private. The primary goal of Business Banks is to generate profits for their shareholders.

- Governmental Banks, on the other hand, offer traditional banking products and are usually distributed. They centralize outsourcing of complex services and are government-owned. The primary goal of Governmental Banks is to provide banking services for the public.

- Shared Banks cater to both private and business customers and aim to generate profits for communities. They offer traditional banking products that are usually distributed. Shared Banks centralize outsourcing of complex services and are member-owned. The primary goal of Shared Banks is to provide affordable banking services (credit) for their members.

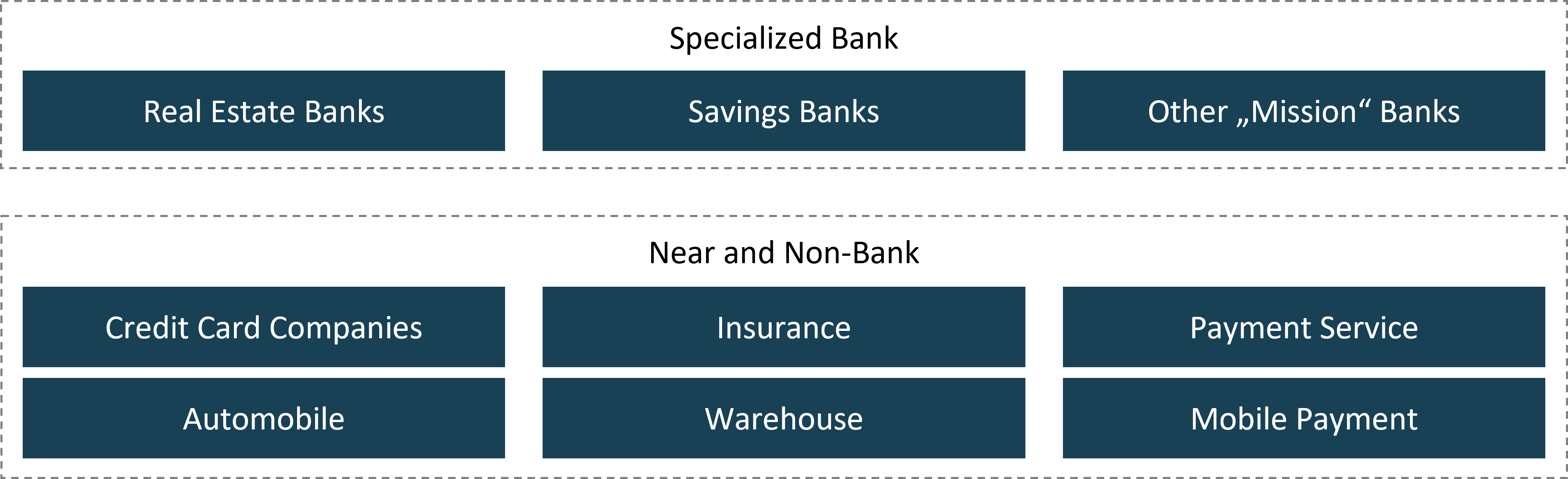

Besides this, there are several more types of banks, which usually specialize in a field or industry.

Overview of special types banks

- Real Estate Banks offer financial service to establish and manage Real Estate, like financing big Real Estate projects and manage financial risks.

- Savings Banks are more focused on private customers to help them save money for bigger investments in their lifes. Usually these includes buying or building property.

- Special Task Banks have a certain mission they follow. Examples can be Development Banks, which have a governmental task to create financial inventives for defined investments under certain terms and conditions.

Regulation

Banks are the backbone of modern economies - trusted with safeguarding our savings, financing our homes, and fueling business growth. But with that power comes risk. Without strong regulation, banks can take excessive risks, mismanage funds, or even collapse - triggering financial crises that ripple through entire societies. The 2008 global financial crisis and their regional banking failures have shown how quickly trust can erode and economies can unravel. In today’s interconnected financial landscape, where digital transactions and complex investment products dominate, robust oversight isn’t just a precaution - it’s a necessity. Regulation ensures transparency, protects consumers, and maintains stability, making it a cornerstone of economic resilience.

International regulation: Basel Accord Framework III

In response to the global financial crisis of 2007–2009, the Basel Committee on Banking Supervision unveiled the Basel III framework in December 2010. This international regulatory standard was designed to make banks more resilient, transparent, and better equipped to withstand future economic shocks.

Basel III built upon its predecessors (Basel I and II) by introducing several key reforms:

- Higher Risk-based Capital Requirements: Banks must hold more and better-quality capital, especially common equity, to absorb losses and protect depositors.

- Leverage Ratios: A non-risk-based measure to prevent excessive borrowing and ensure a minimum level of capital relative to total assets.

- Liquidity requirements: New rules like the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) ensure banks can meet short- and long-term obligations during stress periods.

- Definition on risk calculation standards like a countercyclical buffer where capital buffers that expand in good times and contract in downturns based on financial KPIs, to help stabilize credit supply across economic cycles

„Make sure the bank is only taking risk, it can handle.“

Regulation in the European Union

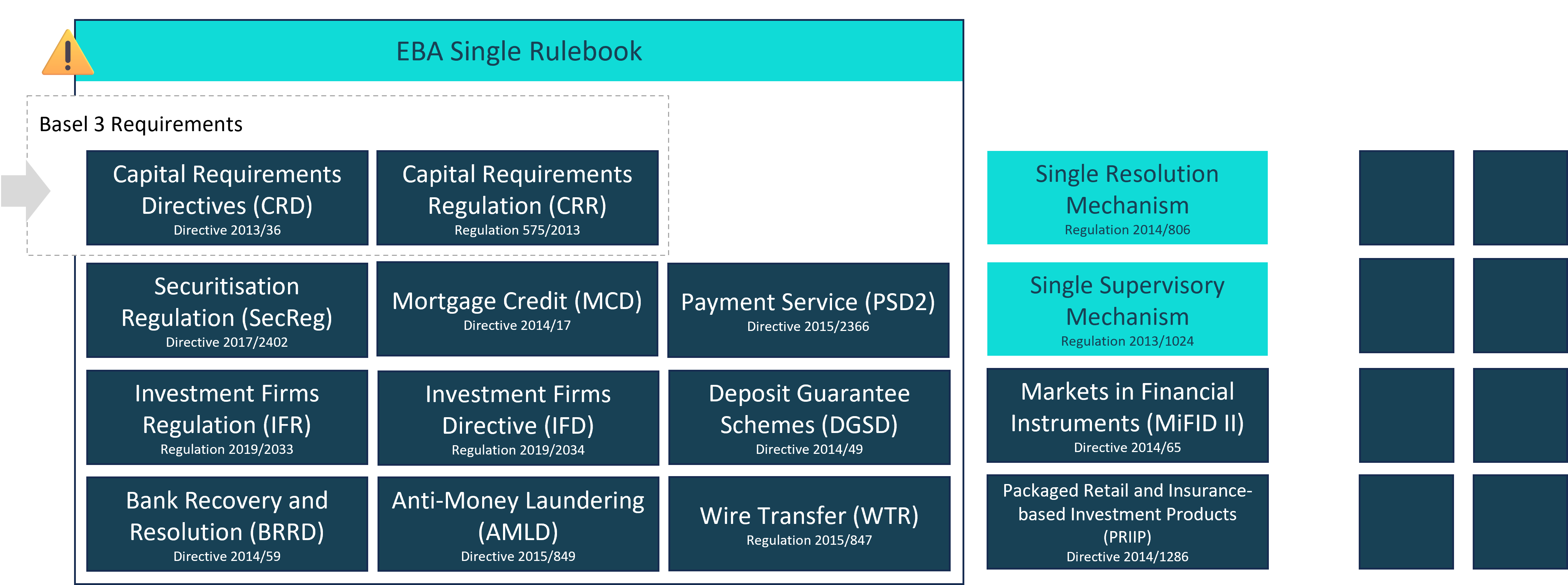

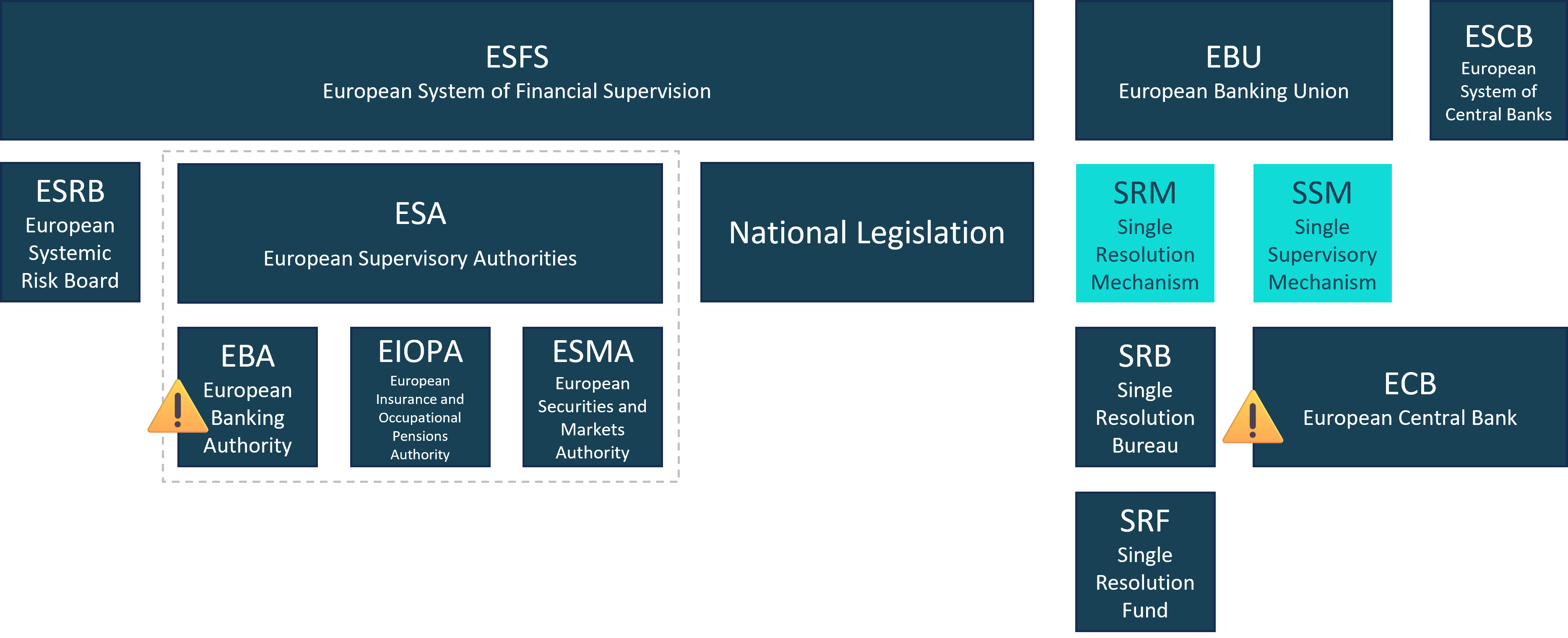

Overview of banking regulation by European Union Banking Laws

The European Union has developed one of the most comprehensive regulatory frameworks in the world to ensure financial stability, protect consumers, and foster a unified banking market. At the heart of this system there are three very important concepts:

1. The EBA Single Rulebook

Created by the European Banking Authority (EBA), the Single Rulebook harmonizes prudential regulation across all EU member states. It ensures that banks operate under a consistent set of rules, closing loopholes and enabling fair competition. This framework translates Basel III standards into EU law and includes regulations like the Capital Requirements Regulation (CRR) and the Capital Requirements Directive IV (CRD IV).

2. Single Supervisory Mechanism (SSM)

The SSM is the first pillar of the EU Banking Union. It places the European Central Bank (ECB) in charge of supervising significant euro area banks, ensuring consistent oversight and reducing systemic risk. National supervisors work alongside the ECB to monitor smaller institutions, creating a multilayered supervisory network.

3. Single Resolution Mechanism (SRM)

Complementing the SSM, the SRM ensures that failing banks can be resolved efficiently without destabilizing the financial system or burdening taxpayers. It includes the Single Resolution Board (SRB) and the Single Resolution Fund (SRF), which coordinate cross-border bank resolutions and fund recovery efforts.

4. MiFID II Requirements

The Markets in Financial Instruments Directive II (MiFID II) enhances transparency and investor protection in EU financial markets. It regulates everything from trading venues and financial instruments to client disclosures and reporting obligations. MiFID II ensures that investment firms act in the best interest of clients and that markets remain fair and efficient.

Overview of the European Union authority bodies

Together, these components form a robust regulatory architecture that not only safeguards the EU’s financial system but also strengthens trust and integration across member states. Besides of the regulation it is also important to set up an effective way on ensuring compliance to the regulation. The previous regulation can be put into context by having an overview of the European Union Authority overseeing the financial market.

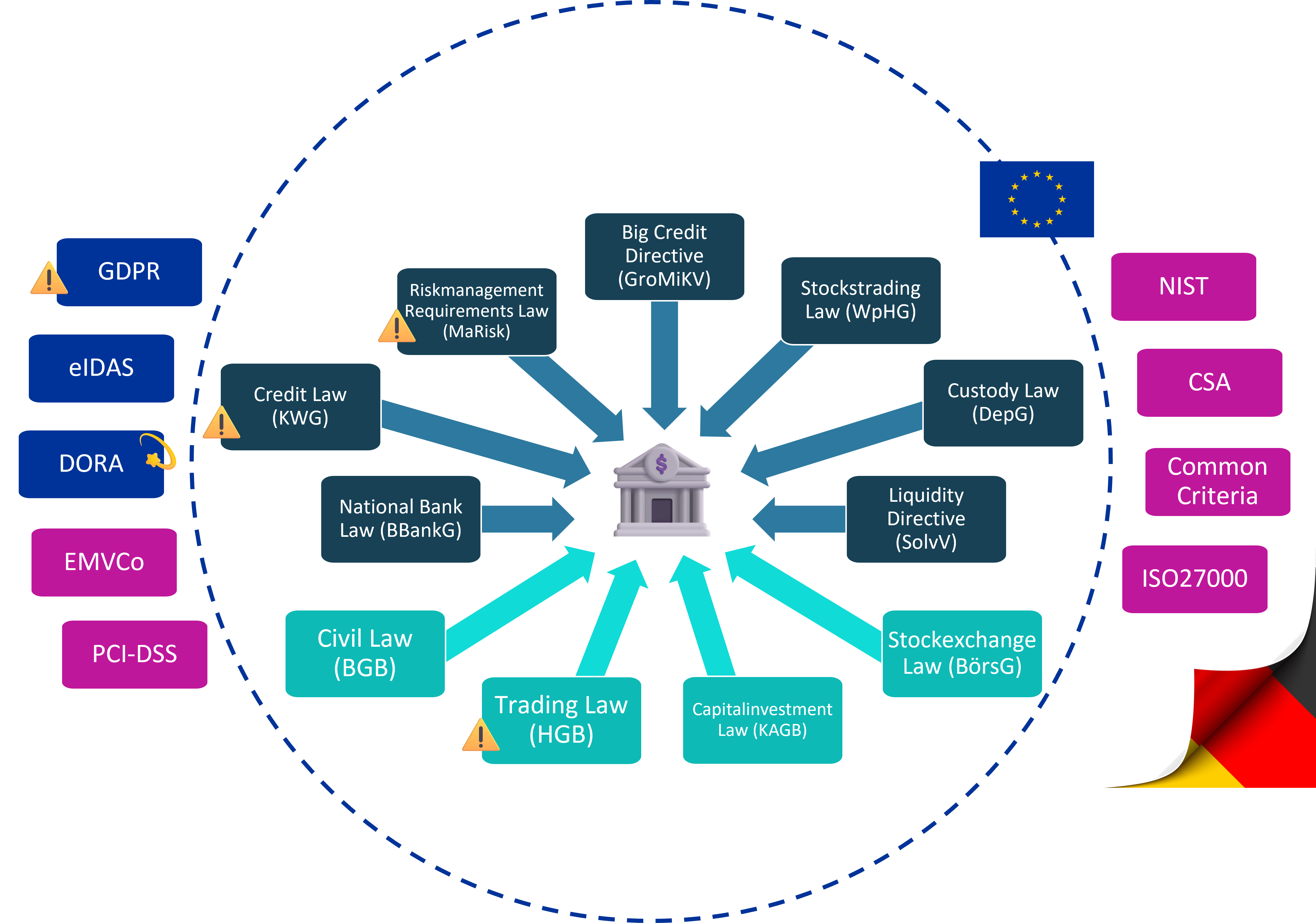

Regulation on National Level

While the European Union provides a robust framework for financial regulation, much of the actual enforcement and adaptation happens at the national level. Each member state is responsible for implementing EU regulations into its domestic legal system, ensuring that the rules are not only harmonized across borders but also tailored to local market realities.

Overview of banking regulation on National Level

Many EU financial laws — especially those affecting banks — come in the form of directives, which are directly applicable and binding. However for regulations, their practical enforcement often requires national legislation, supervisory bodies, and compliance mechanisms. This dual structure ensures both consistency and flexibility.

Beyond core banking rules like the Capital Requirements Regulation (CRR) or the EBA Single Rulebook, there’s a growing ecosystem of cross-sectoral EU regulations and other industry standards that impact financial institutions and need to be considered to ensure compliance. As an example to mention is:

- GDPR (General Data Protection Regulation)

Sets strict standards for handling personal data, affecting everything from customer onboarding to digital banking services. - DORA (Digital Operational Resilience Act)

Introduced to strengthen IT security and incident response across the financial sector, especially in light of rising cyber threats. - PCI-DSS (Payment Card Industry Data Security Standard)

Though not an EU law, it’s widely enforced by national regulators to protect cardholder data and prevent fraud. - ISO/IEC 27000 Series

International standards for information security management, often referenced in national compliance frameworks for banks and fintechs.

Together, with other national laws - like in Germany the Civil Law (BGB) or Credit Law (KWG) and others - these regulations form a multi-layered compliance landscape to have an effect on banking activities.

Sources

- Hellenkamp, D. (2015). Bankwirtschaft. Springer Gabler, Wiesbaden

- Bamberger, M (2019). Payment Services Directive II. Springer Gabler, Wiesbaden